Edgar de Wit

Edgar de Wit

The year-end close is a critical moment for every organization. Consolidating results, producing accurate reports, and providing actionable insights can be challenging, especially when relying on manual processes. With XLReporting, you can streamline your year-end close, reduce errors, and free up time to focus on analysis and decision-making. Here are 7 steps to help you close faster and smarter in 2025.

Such a cliche, but so true: Good planning equals (a lot) less last-minute stress.

In complex, multi-entity organizations, control, predictability, and accountability are key. What slows organizations down is rarely the lack of structure around who delivers what, when, and with which dependencies.

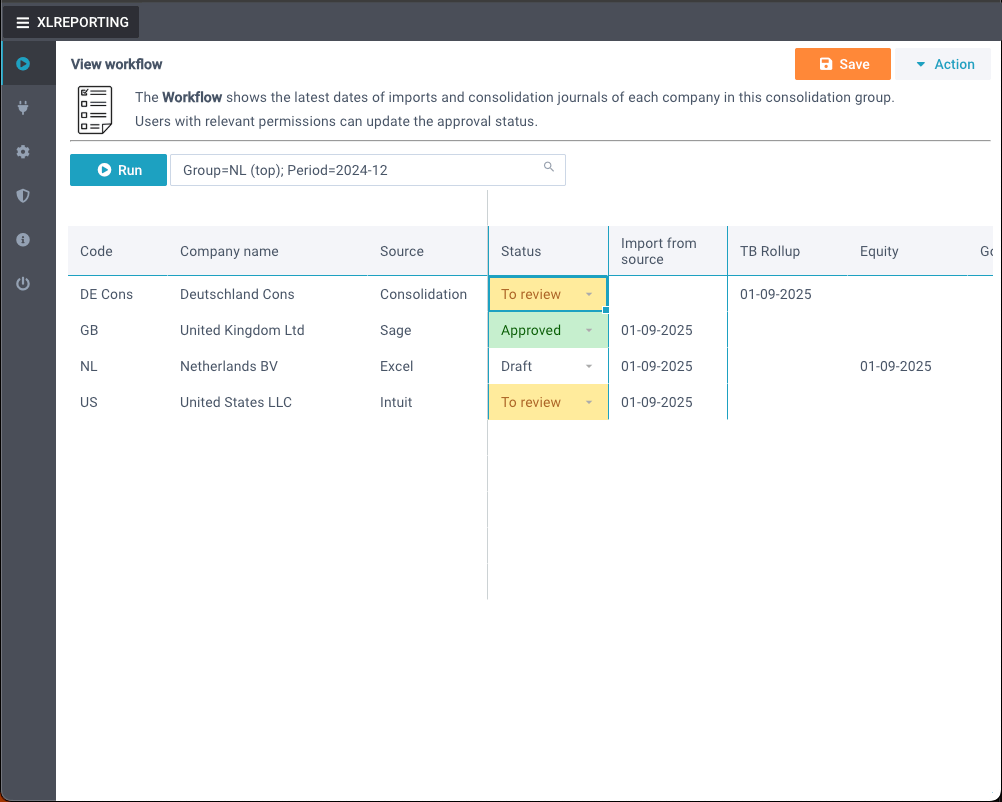

XLReporting enables the year-end close to translate into a governed, repeatable process. Closing milestones are defined centrally and applied consistently across entities, while still allowing for local differences in timing or complexity.

You no longer need to follow up on cut-off dates, reconciliations, or intercompany matching for final submissions through the shared framework.

So what does this mean? This means that each entity operates against clearly defined (joint!) expectations. Booking cut-offs, inventory reconciliations, intercompany alignment and trial balance delivery are scheduled as part of an integrated (again, joint) closing calendar. Ownership is very clear, progress is (very) visible at the group level, and delays surface immediately, so there's still time to act.

Everyone who works or has worked at a mid-size and Enterprise organization knows that assurance trumps reminders. By linking deadlines, task ownership, and dependencies, XLReporting provides real-time insight into the status of the close across regions and business units. This transparency allows group finance to anticipate risks, intervene early, and maintain momentum throughout the closing cycle. And it will almost become impossible to miss anything thanks to the automated alerts that have replaced manual follow-ups, reducing coordination effort while strengthening accountability. Instead of reacting to missed deadlines, one can actually manage the close as a controlled process.

This not only supports governance, but also improves confidence in the numbers, and frees the finance team to focus on analysis, insight, and strategic dialogue, exactly where finance creates the most value.

With clean, reliable data, you spend less time fixing numbers and more time analysing results.

For example: Automating trial balance imports, intercompany transactions, and consolidation can reduce closing time substantially. In a four-entity structure, manual TB extraction, formatting, validation, and upload typically take 3 to 5 hours per entity. Automated imports cut this to 10 to 20 minutes, saving 10 to 15 hours per month. Intercompany matching costs typically 6 to 8 hours; automation reduces this to 1 hour or less. Consolidation. Often, 1 to 2 days of manual work can drop to 2 to 4 hours with automated mapping and elimination.

Total time saved: ≈ 20 to 30 hours per month, and 3 to 5 full working days during year-end.

Continuous reconciliation speeds up your close and improves accuracy.

Driver-based insights allow you to make smarter, faster strategic decisions.

Automation reduces manual work, increases transparency, and ensures consistency across your organization.

By planning early, automating data, reconciling organisations, leveraging driver-based insights, collaborating effectively, reviewing thoroughly, and automating reporting, all within XLReporting, your finance team can close faster and smarter.

XLReporting is a single platform that integrates reporting, budgeting, consolidation, and AI-assisted analysis. Reduce manual work, improve accuracy, and focus on what truly matters: insights, strategy, and growth.

Want to see how XLReporting can transform your year-end close in 2025? Book a demo today and discover how your finance team can work smarter, not harder.

Back to the listSchedule a Meeting with one of our Planning and Reporting Experts.

Let's Talk