Blog section

Filter on topic, author, or type:

Budgeting | Cashflow | Consolidation | Forecasting | Non-Profit | QuickBooks | Releases | Reporting | Review | SetupEdgar de Wit | Johan Smith | Nicola van Rijn | Petra Weisenborn

Recent blogs | Popular blogs | All blogs

How future proof are your finances?

Running a business today means preparing for what you can't predict. One supply issue, market shift, or regulation change can shake your entire plan. That’s why smart firms often lean on accounting firm software with built-in scenario planning tools. Scenario planning helps you visualize what-if situations, like a sudden dip in revenue or an unexpected hiring freeze. Instead of reacting, you respond with clarity, and you can see risks before they hit.

Top business software directory Research.com recognizes XLReporting

XLReporting, an advanced online platform for financial planning and reporting, has earned a spot on Research.com's prestigious list of top business software solutions. Recognized for its robust consolidation, forecasting, and reporting capabilities, XLReporting stands out as a trusted tool for organizations seeking to automate financial workflows and eliminate the inefficiencies of manual spreadsheets.

When do you need a CPM?

If you are working with multiple entities and currencies, you probably also have several reporting layers and independent strategic goals. Managing finances for your business means that you’re constantly reporting on what has happened but also need to look ahead to make timely adjustments if required. And with global decisions changing on a daily, what’s happening tomorrow could be completely different from today’s standards.

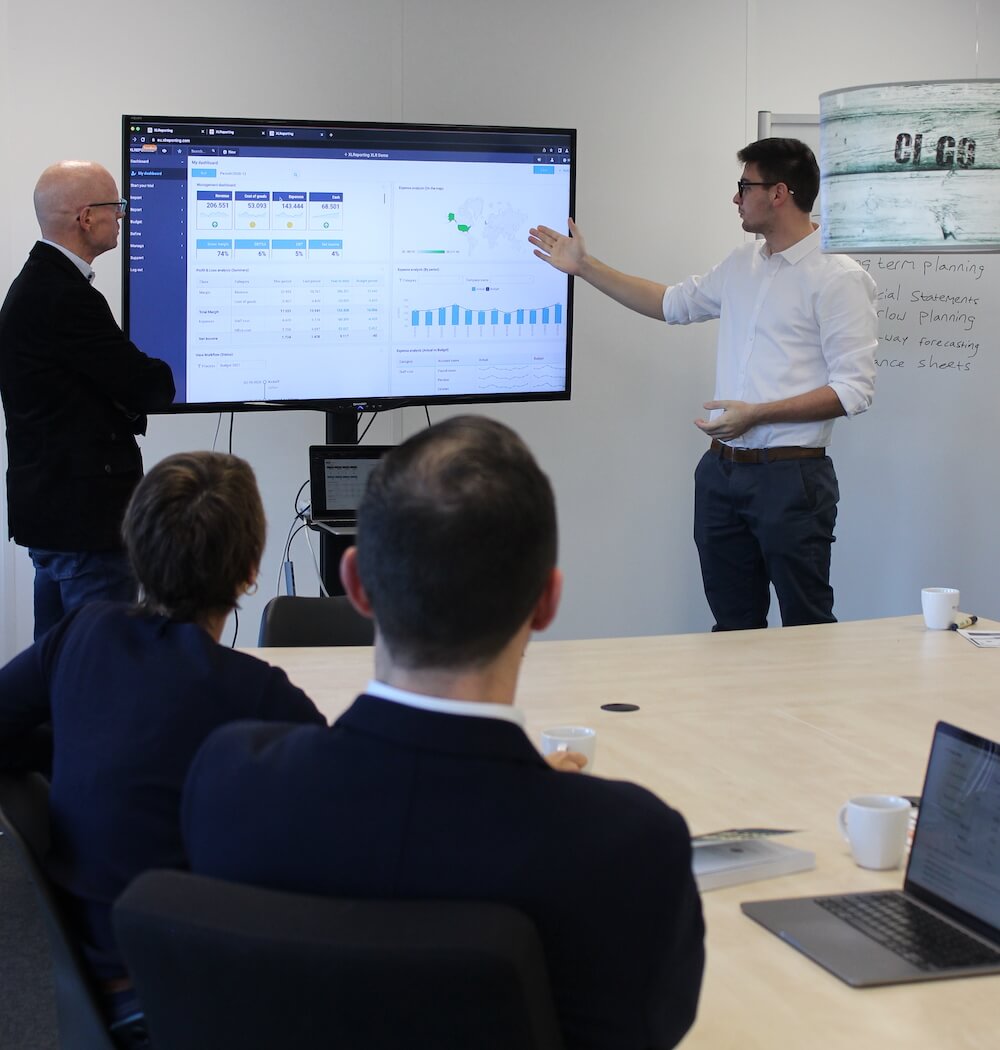

Interview with the founder

Johan Smith is one of the founders of XLReporting, and he still likes to stay close to the action, especially when it comes to our technology, operations, and IT security. But beyond the job title, what really matters to him is making sure we stay focused on helping our clients make better decisions. That’s what this whole journey is about.

Forecasting Income in the Healthcare Sector

Forecasting income is a core function in any sector, but in public healthcare, it is uniquely complex. Unlike commercial enterprises with predictable revenue streams or even non-profits with established donor bases, public health organizations must deal with funding uncertainty, policy shifts, and fluctuating service demands.

Forecasting Income for Non-Profit

Forecasting income is hard enough in commercial businesses. But in the non-profit sector, it’s a whole different ballgame. Not because non-profits don’t plan carefully (they do) but because the very nature of their income is far more uncertain, especially when you look at the mix of public funding and fundraising income, and the complexities of restricted income.

The Top 5 Pitfalls in Budgeting

Budgeting is a critical process in every organization, but let’s be honest, it’s rarely a smooth one. It’s often stressful, time-consuming, and frustrating. And by the time it’s finally "done", it already feels outdated.

If You Break It, You Own It

You’re making a last quick change in an Excel spreadsheet just minutes before the deadline, and then it all breaks .. formulas are suddenly broken, and numbers don’t make sense anymore. If you’ve worked in finance long enough, you have lived the experience. And felt the pain.

When Control Becomes a Constraint

In many organizations, the forecasting process lies in the hands of one person, often the CFO or the FP&A manager. Typically, that person has spent years refining an elaborate Excel model, one that contains the company’s financial heartbeat. It’s smart, complex, and familiar. It represents a deep personal investment and effort, and "it works" in the sense that numbers are delivered every month.

Fixing the Reports is not Fixing the Problem

Often, we see highly educated FP&A professionals, with sharp Excel skills and impressive dashboards, struggling to make sense of their information. Why? Because underneath all those visuals and formulas often lies a missing foundational skill: Accounting.

Still taking over a week to close your books?

A recent article from CFO.com revealed something that might sound familiar: 50% of finance teams take week or more to close their books, and nearly 94% of finance teams still rely on Excel for their month-end close. That statistic alone says a lot.

The Problem Isn’t Excel, but how it is used

Excel is a brilliant tool, when used well. And that is the key: when used well, and for the right purpose. Unfortunately, I keep seeing the wrong use. A growing mountain of complexity, misuse, use for the wrong purpose, and dangerous workarounds, disguised as "productivity".

What your Budget says about your Organization

Over time, every educational institution develops its own internal logic for how income and costs should be distributed. Whether it’s about allocating government funding, assigning departmental budgets, or forecasting student-related costs. There is rarely a one-size-fits-all approach.

Bottom-Up Budgeting Beats Top-Down

In many organizations, budgeting season still feels like a game of telephone. Finance builds a model, leadership sets targets, and somewhere along the line, budget holders are handed “their numbers”, numbers they had little input on, but which they are now expected to deliver. This classic top-down approach might be efficient on paper, but in practice, it often leads to misalignment, frustration, and missed opportunities.

Period Selection in Reporting

When you build reports in Excel, you know the drill: endless tabs, long formulas, nested IFs, and VLOOKUPs that stretch across your screen like spaghetti. Difficult to read, and hard to maintain.

Financial Forecasting Is Not Fortune-Telling

“Last year plus X%” is not a forecast. It’s a guess. And guesswork is not a strategy, nor is it management. Yet that’s exactly how many organizations still approach budgeting and forecasting. They look at what they did last year, tack on a bit of optimism or pessimism, and call it a plan. But real forecasting is not about wishful thinking or crystal balls.

How to Navigate a Business

After decades in finance and technology, working in executive roles, building systems, and guiding businesses through growth and transformation, one truth has stayed with me: You can’t navigate on poor data.

Why Finance Teams Are Shifting to Automated Rolling Forecasting

In today’s fast-moving economy, static annual budgets are no longer enough to guide strategic decision-making. Unpredictable markets, changing cost structures, and global disruptions have made it essential for finance teams to stay agile. That is where rolling forecasting comes in, and when automated, this becomes a true game-changer.

A $28 Billion Excel Sheet: Why Finance Needs Better Tools

Recently, the NZ Herald published a startling story: Health NZ, responsible for billions in public healthcare spending, was managing a NZ$28 billion budget using a single Excel spreadsheet.

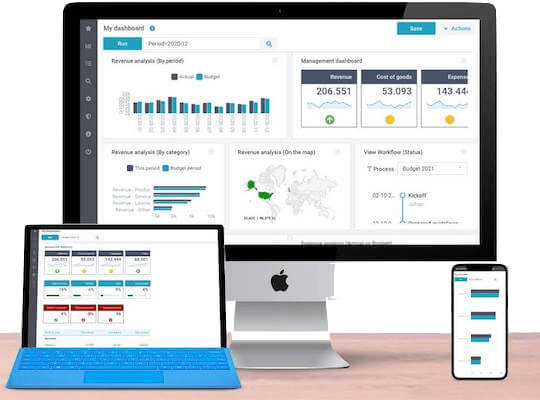

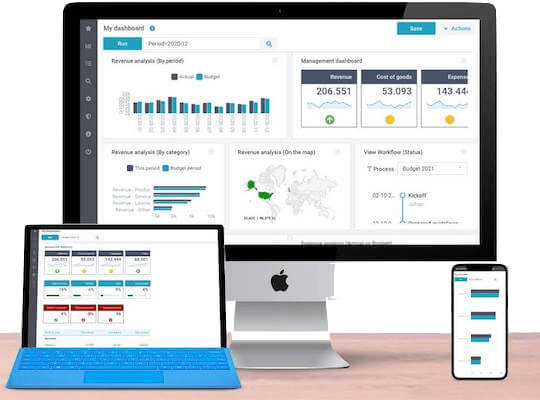

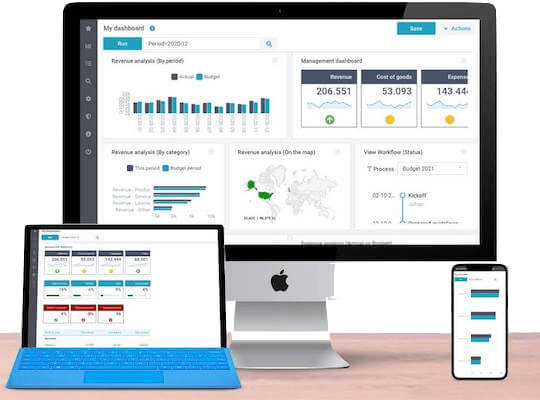

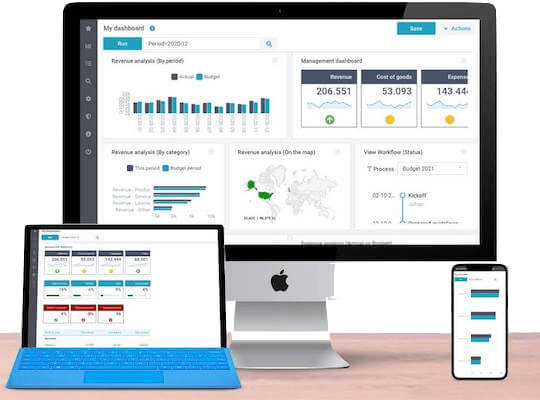

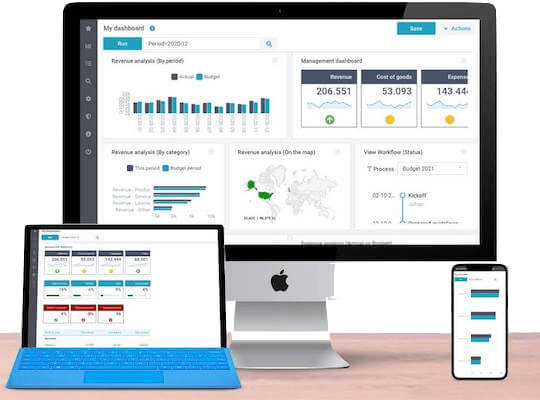

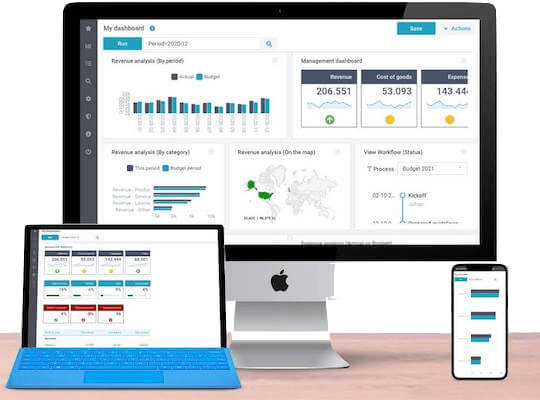

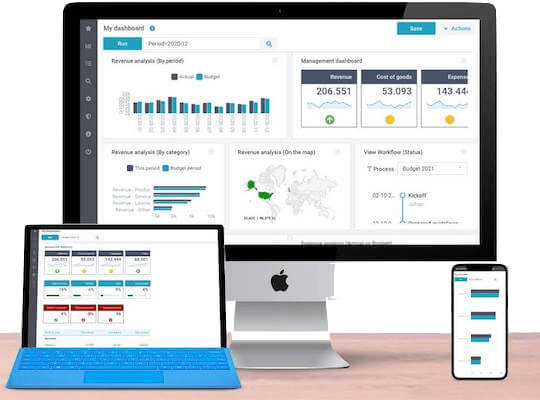

The One-Stop Solution for Finance Professional

Finance professionals handle complex processes every day; consolidating numbers, generating reports, and forecasting the future. Yet, too often, these critical tasks rely on spreadsheets, manual data entry, and disconnected systems, leading to inefficiencies and errors.

Why Revenue Forecasting Matters

Revenue forecasting is essential for businesses looking to plan ahead, allocate resources effectively, and drive growth. However, traditional forecasting methods often involve manual processes, scattered spreadsheets, and inaccurate data. With XLReporting’s Revenue Planner, you can streamline your revenue forecasting process and gain real-time insights to make informed business decisions.

Involving your team in budget planning

Budget planning is often considered the responsibility of the finance department. That makes sense, it’s where the expertise lies. But organizations that actively involve their teams in the budgeting process often see better financial outcomes and increased engagement across departments.

XLReporting: a trusted European alternative in uncertain times

In times of economic uncertainty, businesses seek stability, control, and transparency. With recent developments affecting the U.S. economy, many organizations are reconsidering their reliance on American software. As a result, interest is growing in trusted European alternatives - solutions that offer the same power and flexibility, but with a different perspective on ownership, privacy, and support.

Budgeting beyond traditional boundaries: A smarter approach

Traditional budgeting often follows a predictable pattern: last year’s figures form the foundation, adjustments are made, and the final numbers are set in stone. But is this approach still effective in today’s dynamic business environment?

The Complete Guide to Financial Consolidation with XLReporting

Managing financial data across multiple entities can be complex, but financial consolidation ensures that businesses get a clear, unified view of their performance. With XLReporting, companies can streamline their consolidation process, eliminate errors, and generate accurate reports, all in one platform.

Not an April fool: The high cost of low quality data

Every April 1st, the internet floods with pranks and hoaxes. But here’s a statistic that’s no joke: businesses in the U.S. waste over $3 trillion each year due to bad data.

5 Ways XLReporting can help your organization

In today’s fast-paced business environment, organizations need efficient, automated solutions to streamline financial processes. XLReporting offers a suite of features designed to help you reduce manual tasks, improve accuracy, and save time.

Which financial solution fits your organization?

Companies and finance teams have various solutions available for reporting, budgeting, and analysis. But which one is the best fit for your organization? In this blog, we compare the pros and cons of different systems: accounting software, spreadsheets, BI/CPM solutions, and XLReporting.

Still combining PowerBI with Excel for your management reports?

If you are reading this, there is a big chance that you, just like many organizations, have invested in PowerBI and similar BI solutions.

Budgeting in times of Economic Decline: How to stay in control

Budgeting is challenging even in times of economic growth, but it becomes even more critical when your organization faces financial uncertainty. Preparing a budget is not only a legal obligation for an educational institution, but also an essential tool for good financial management.

Key Pain Points in Accounting and How to Solve Them

Accounting and financial reporting can often be a challenge, especially for businesses that manage multiple administrations or produce regular management reports.

Year review of 2024

The year 2024 is almost over. At XLReporting we’re looking back on a wonderful year. It was a year with strong focus on security, new functionality, and successes for our partners and clients.

What is new in release 39

We finish 2024 with our latest release 39. This includes several improvements and features that customers asked for, along with many other features.

Our AI Assistant ensures better reporting

The AI Data Assistant is your reliable partner with all kinds of data operations, such as converting data in your dataset, mapping your chart or accounts to a reporting standard, splitting data, or translating terms and definitions.

Financial scenario planning - the Why and How

Scenario Planning is a powerful tool to minimize financial surprises and get a grip on the future. Scenarios help deal with uncertainties and respond to them when they occur. But how do you do it? Using a fictional healthcare facility as an example, I will show you how and why scenario planning makes sense.

Allocating Funds in Educational Budgeting

Lumpsum funding is commonly encountered in education. By lumpsum funding, we mean that an organisation receives an amount of money for a student without a breakdown in parts labelled how the organisation should spend the money. When allocating the received money to the teams with the students under their wing, an educational institution has several choices.

The Importance of ISO 27001 Certification

Organizations must take measures to ensure that information security is in good order. We at XLReporting take information security, data protection, and privacy very seriously.

How to Supplement Information to your HR system

Basic reports from online systems often must provide the correct representation for your analyses. This is usually solved by exporting the information to your favourite spreadsheet. We frequently see this happen with accounting software.

Best Reporting Options for Simplifying QuickBooks Desktop

Are you a QuickBooks Desktop user tired of spending hours manually formatting and compiling reports in Excel? Well, we have some excellent news for you! Some game-changing alternatives will simplify your reporting processes and save you valuable time.

Uncovering the Hidden Costs of Forecasting in Excel

Every organization does budgeting and forecasting, and often Excel is the most obvious option. Every finance professional knows Excel, a spreadsheet can be quickly created, and you can freely adjust it as desired. But is Excel really free?

Work together for Successful Investment Planning

We are diving into a fascinating topic that arises when local teams and facility management come together: asset investment planning. We all know the importance of maintaining and upgrading our facilities, but what happens when different voices enter the conversation?

Why Forecasting with Excel won’t let your Organization Excel

Forecasting with Excel is riddled with problems. It does not produce reliable forecasts because data quickly gets outdated, and the knowledge about the spreadsheet is often held by only one person within the organization.

Questions to ask Forecasting Software Vendors

Forecasting your income, expenditure, and cash flow is essential for managing your business finances and planning for the future. In simple terms, informed decision-making results in better outcomes.

How to Deal with a Reorganization when Budgeting

Every day, our value-added partners solve reporting and budgeting challenges for their clients with XLReporting. One of the challenges is a reorganization during a budget period.

What is new in release 38

We finish 2023 with our latest release 38. This includes several improvements and features that customers asked for, along with many other features that further expands the use of XLReporting.

Year review of 2023

The year 2023 is almost over. At XLReporting we’re looking back on a wonderful year. It was a year with great projects, lots of new functionality, and successes for our partners and customers.

Important Financial Statements for Non-Profit Organizations

Non-Profit organizations, just like any organization, must have an overview at all times of their financial position, both actuals and compared to budget. This is important for budgeting, planning, and decision-making.

How to Do Cash Flow Forecasting in Xero

Cash flow forecasting is essential for managing your business finances and planning for the future. It involves predicting the inflow and outflow of cash over a specific time, typically a month or a quarter.

Integrate Xero with Reporting and Forecasting: Step-by-Step

No matter your business or industry, it is essential to prioritize financial reporting and budgeting within your organization. The finance department handles these tasks daily with precision to ensure accurate data.

How To Forecast Revenue With Ease

The planning of revenue is often the starting point of your budget cycle. Your revenue expectation forms the basis of the budget. This article explains what the Revenue Planner can do and its benefits.

Why Good Financial Data Quality is Crucial for Your Business

In the fast-paced world of modern business, accurate and dependable financial data is. crucial. Whether your organization is big or small, poor data quality can have significant consequences.

Best Practices Budgeting Tool for Non-Profit

For any non-profit organization, budget management is a critical task that can be daunting, time-consuming, and expensive. Even the most experienced staff member can find it hard to stay up to date on budgeting best practices and processes.

Effective Tools and Methods for Cash Flow Forecasting

The COVID-19 outbreak brought to light (often in a dispruptive way) the significance of effective procedures for managing liquidity risk. Cash management went from a secondary concern for business owners to a primary one due to significant upheavals in global supply chains.

XLReporting named as Key Player in Budgeting Software Market

The need for advanced financial tools and the need to track and forecast income and cashflow is on a rise and so is XLReporting! We have been busy and that hasn’t gone unnoticed in the market. We have been mentioned favourably in the press on several occasions over the past years.

Analyze Past Cash Flow: A Critical Step

As a financial controller or director, you understand the importance of cash flow management in ensuring the success of your business. One of the first steps in effective cash flow planning is the analysis of past cash flow.

Maximize the Power of Cash Flow Analysis

Due to its popularity, Excel is widely used by organizations for cash flow analysis. However, it has some drawbacks that can make the process difficult, such as collecting data from various sources and manually creating and automating budgets.

Reduce Cash Management Risk

As the global financial landscape continues to evolve, companies face an increasingly complex and unpredictable environment when it comes to managing their cash flow.

A Guide to Consolidation with QuickBooks

Consolidating financial reporting for multiple companies can be a daunting task, especially when working with QuickBooks. However, with the right solution, you can streamline the process and gain confidence in your numbers and decisions.

Year review of 2022

We are delighted to present our Year 2022 Review, a celebration of the major accomplishments of the XLReporting team during this year.

What is new in release 37

We start this new year with our latest release 37. It contains many improvements and features that customers asked for, along with many other features that you will enjoy.

A step-by-step Guide to Financial Consolidation

Financial consolidation can be a complex process, and many don’t know where to start. That’s why we wrote this article providing a step-by-step guide to help you understand the financial consolidation process and what it takes to successfully consolidate your finances.

The Importance of Cashflow Forecasting

Cashflow forecasting should be an essential practise in every company, as it enables you to predict and manage the inflow, outflow, and availability of cash at every point in time.

What is new in release 36

We hope everyone had a good holiday and is coming back to work with renewed energy. We have used the summer period to work hard on our platform and to prepare it for the new reporting and budget year.

Define extra dimensions

Do you have multiple dimensions in your business (e.g. departments, locations, cost centers, product groups, sales channels etc) but are you unable to record these transactions properly in your accounting system?

Improve Reporting, Budgeting and Analysis in 5 steps

Organizations of all sizes, in every industry, rely on accurate and insightful reporting to make critical decisions. This blog post outlines 5 steps that can help you improve reporting, budgeting and financial analysis.

Free up Time from Monthly Financial Reporting

Monthly financial reporting is something many people have to do for their job, but it can take a lot of time and effort to compile all the information and put it together.

Build the Right Budget Structure for your Business

In the past, business owners have been content with simple monthly reporting. But times have changed and financial budgeting and forecasting has become critical.

Report on Xero Tracking Categories

We often receive this question: "How can we report on Xero tracking categories with multiple Xero administrations?"

What is new in release 35

Barely a month ago, we had a major release with many new features. And now we’re releasing another major update. We’re excited to let you know what’s new.

Minimize Headaches at Reorganizations

Creating reports for departments is a lot of work if you depend on spreadsheets. It becomes even more problematic when your company decides to reorganize.

Year review of 2021

With 2021 behind us, it is a good time to look back on what we have achieved. We added lots of new features and improvements to XLReporting this year.

Stop relying on spreadsheets

90% of all businesses rely on spreadsheets for their financial reporting and budgeting. It is time-consuming to refresh the numbers every time, make changes, update formulas etc.

Improve your Reporting in 5 steps

Lots of people are struggling to produce their reporting on time every month. Multiple deadlines, last-minute changes, data that arrives late etc. Little time is left to analyze the numbers.

Find the Right Metrics in your Business

When you build your reports, it is important you focus on the metrics that tell the story behind your numbers. What drives your business, and what is driving your numbers?

Optimize your Chart of Accounts

Many companies end up with complicated reporting spreadsheets, just because their Chart of Accounts is messy. Too many accounts, too few, inconsistent classification etc.

Build effective Budget Models

We often see budgets that try to predict the future in great detail without focussing on the fundamentals of the business, and without clear goals and actions as an outcome.

Find the Dimensions in your Business

Many companies have multiple "dimensions" in their business but are unable to analyze their results. That is difficult if you can’t report numbers for each of these dimensions.