How to use the Consolidation Journal

What does this model do?

The Create Journals input model lets you create journals for a selected consolidation group and journal type. It also provides two powerful overviews:

- A matrix with intercompany balances (based on the imported trial balance of your accounting system).

- A matrix with intercompany transactions (if you have imported these).

This gives you both the tools to post consolidation journals and the insight into intercompany positions.

How does it work?

- Select the consolidation group

Use the field Group to choose the consolidation layer. Groups are defined in your Global Settings under Company list. - Select the consolidation step (journal type)

Choose which type of consolidation journal you want to post. These are also defined in Global Settings.

Common examples are:- Equity

- Goodwill

- Interco P&L

- Interco BS

- Select the period

Finally, select the reporting period for which you want to create the journal.

The screen layout

The model screen is divided into three panels:

1. Journals

- Post adjustments for each company in the selected consolidation group.

- You first see the imported balances.

- Based on that, you can enter journals as a fixed amount or a percentage of the balance.

- There is also a column Auto correction which automatically retrieves the intercompany transaction balance to help you create elimination journals more efficiently.

- For fixed amounts, you can also provide description, date, and reference.

Booking options:

- Transaction – posts the amount or percentage to the contra account To which account.

- New balance – adjusts so the final balance equals the entered fixed amount or percentage.

- Eliminate – eliminates the balance of the imported account against the target account.

- Reclassify – same logic as Eliminate, used for reclassification.

Then select the contra account in the column To which account.

Optionally, tick Reverse if you want the journal to be automatically reversed

in the next period.

2. IC Balances

Shows an overview of intercompany balances within the consolidation group, so you can see open positions before posting journals.

3. IC Transactions

If you imported intercompany transactions, this panel shows a transaction-level overview to reconcile activity between companies.

Practical examples

Example 1 – Eliminate intercompany receivable

Company A has a receivable of €100,000 against Company B. In the Journals panel, you

enter a journal to Eliminate this receivable, posting it against the

elimination account. In the IC Balances panel, the receivable disappears from the

consolidation balances.

Group: European Subsidiaries

Journal type: Interco P&L

Period: 2023-12

Example 2 – Minority interest (non-controlling interest)

You want to post the share of a minority shareholder as a percentage of equity. In the Journals

panel, select the relevant equity account, set the % of balance to the minority

share (e.g. 25%), and choose the transaction type Transaction. The system

calculates and books the correct percentage automatically.

Example 3 – Intercompany revenue reclassification

Company A has revenue from Company B that must be eliminated against cost of sales. In the Journals

panel, select the revenue account and choose Eliminate. The To which

account field specifies the matching cost of sales account. If this involves a shared

revenue account (used by multiple companies), you can either enter a fixed

amount for the correct share, or let the system pick up the value automatically

through the Auto correction column from the imported IC transactions. This

ensures that the elimination matches actual transaction values.

Example 4 – Auto correction with manual adjustments

The Auto correction column retrieves the intercompany transaction balance

automatically. You can then adjust this value manually by entering a fixed

amount (for corrections) or a % of balance (for proportional

eliminations). This is useful when imported transactions don’t fully match and require small

manual adjustments.

Tips and best practices

- Define your consolidation groups and journal types clearly in Global Settings before using this model.

- Review the IC Balances and IC Transactions before posting journals.

- Use the Auto correction column to simplify elimination postings and reduce manual work.

- Use the Reverse option for temporary adjustments (e.g. goodwill allocations or year-end accruals).

- Always provide clear descriptions and references for audit trail and later review.

Save your changes

Once you completed your journal, click Save (or Ctrl+S).

Choose from Actions

When working in this journal, you can click the Actions button in the right-top of the screen to open a dropdown menu with further options:

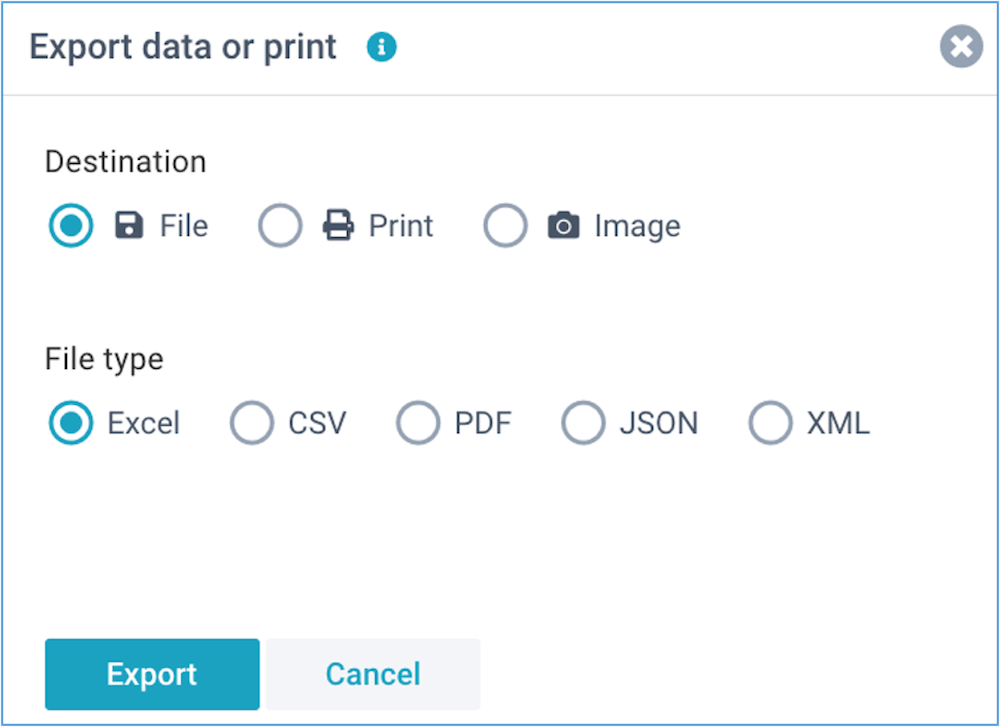

- Export to Excel or PDF file

- Print the report

Export to Excel or PDF

To export the current layout to Excel, or to a PDF file, or to print it, click the Actions button in the top right corner of the screen, and then select Export data or print.

You can export the report to a large variety of file formats, Excel and PDF being the most often used.

By following these steps, you'll be able to enter consolidation journals that are included in your consolidated financial statements.

If you like to read more detailed instructions, click here.